Authored by the Hydrogen Council in collaboration with McKinsey and Company, Global Hydrogen Flows addresses the midstream challenge of aligning and optimizing global supply and demand. It finds that trade can reduce overall system costs.

Continue readingNew hydrogen projects achieve record numbers globally with even greater urgency for final investment decisions to attain net zero

A new report published today by the Hydrogen Council emphasizes the heightened urgency to increase investment in large-scale hydrogen energy projects.

Continue readingHydrogen Insights 2022

Authored by the Hydrogen Council in collaboration with McKinsey and Company, Hydrogen Insights 2022 presents an updated perspective on hydrogen market development and actions required to unlock hydrogen at scale.

Continue readingFitfor55 – fit for purpose?

The RePowerEU plan, unveiled on May 18, builds on the European Commission’s March 8 communication, reaffirming Europe’s resolve to rapidly reduce its reliance on Russian fossil fuels.

Continue readingSeven New Members Join The Hydrogen Council to Advance the Global Clean Energy Transition

The Hydrogen Council welcomed seven new members, including Adani Group and Bloom Energy, reinforcing its commitment to advancing the global clean energy transition.

Continue readingNew horizons for hydrogen trade: Transporting clean energy overseas

Transitioning to clean energy demands significant change, with global hydrogen demand needing to reach 140 MT by 2030 and 660 MT by 2050, up from 90 MT in 20201. Understanding the scale and complexity of this transition remains a challenge despite recognizing its necessity.

Continue readingHydrogen Council announces leadership change: original founder Air Liquide passes reins to new co-chair Kawasaki Heavy Industries, Ltd.

Original Founder Air Liquide Passes Reins To New Co-Chair Kawasaki Heavy Industries, Ltd.

Continue readingHydrogen Council membership grows to more than 130 members, with eleven new companies committing to foster development of the hydrogen economy

The Hydrogen Council, a global CEO-led coalition driving energy transition through hydrogen, welcomed eleven new members today, bringing the total to 134 companies worldwide spanning the hydrogen value chain and committed to decarbonizing economies.

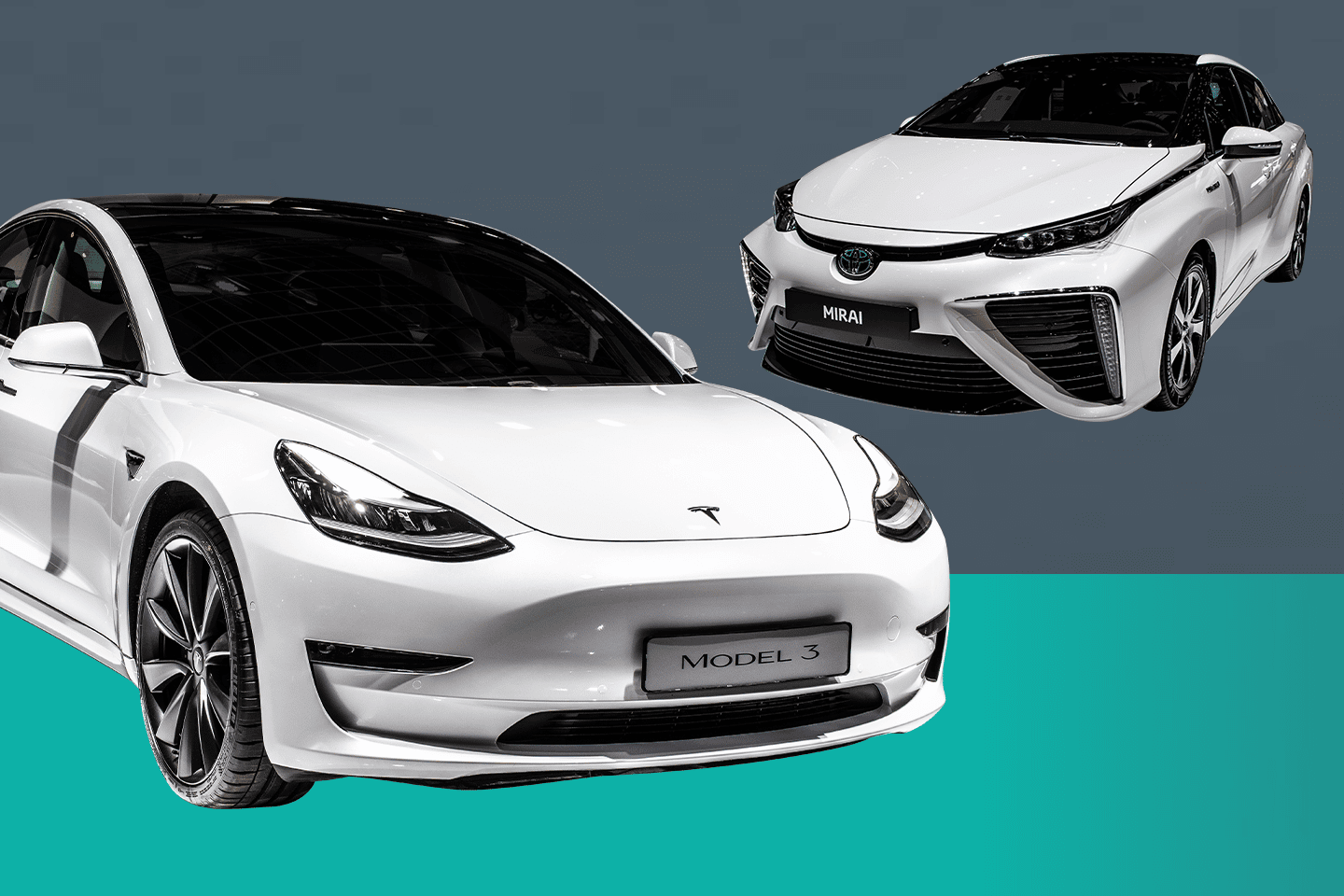

Continue readingNet zero isn’t a zero-sum game in transport – both battery and fuel cell electric vehicles are needed

The movement of people and goods throughout society has always depended on more than one technology. Different individuals, businesses, geographies and segments of the transportation system have different needs and no single solution can meet all of them alone.

Continue readingCEO Coalition to COP26 leaders: Hydrogen to contribute over 20% of global carbon abatement by 2050– Strong public-private collaboration required to make it a reality

The Hydrogen Council calls on global leaders at the UN Climate Change Conference in Glasgow to translate hydrogen plans into action, highlighting its crucial role in deep decarbonization and offering comprehensive policy tools for bold action.

Continue reading