The latest Hydrogen Insights report outlined why the pace and scale of deployment need to accelerate dramatically to meet global climate goals. That’s despite a sevenfold growth in FID to $75 billion in committed capital and a 92% growth in new project investments in the last six months.

Continue readingPermitting bottlenecks hamper hydrogen projects

The latest Hydrogen Insights report from McKinsey and the Hydrogen Council reveals over 350 new large-scale hydrogen project proposals announced in the past year.

Continue readingDaryl Wilson on project backlogs, policy complexities and China’s advantage

The EU has a “very important responsibility” in increasing the amount of projects reaching final investment decision (FID), Daryl Wilson, Executive Director of the Hydrogen Council, told H2 View.

Continue readingEU hydrogen policy mired in complexity

The EU is nearing completion of regulations to boost its hydrogen economy, but some aspects may need revision for global competitiveness.

Continue readingPolicy headwinds for clean hydrogen in Europe temporary: Hydrogen Council

The Hydrogen Council informed S&P Global Commodity Insights that the policy obstacles confronting low-carbon and renewable hydrogen projects in Europe are expected to be short-lived, with rapid deployment anticipated once regulatory certainty is achieved.

Continue readingThe unveiling of hydrogen’s bigger picture

Hydrogen investments and deployment have been steadily gaining momentum for years, with acceleration since 2020, revealing the broader picture and the magnitude of the task ahead.

Continue readingHydrogen projects now valued at $330 billion but face challenges, says industry chief

Globally, there are ambitious plans to increase hydrogen fuel production, seen as crucial for powering nations and reducing greenhouse gas emissions in the clean energy economy.

Continue readingThe ‘future is unfolding’ now with hydrogen, says Hydrogen Council

Our Executive Director Daryl Wilson spoke to CNBC and said the hydrogen story has been unfolding in the last five years.

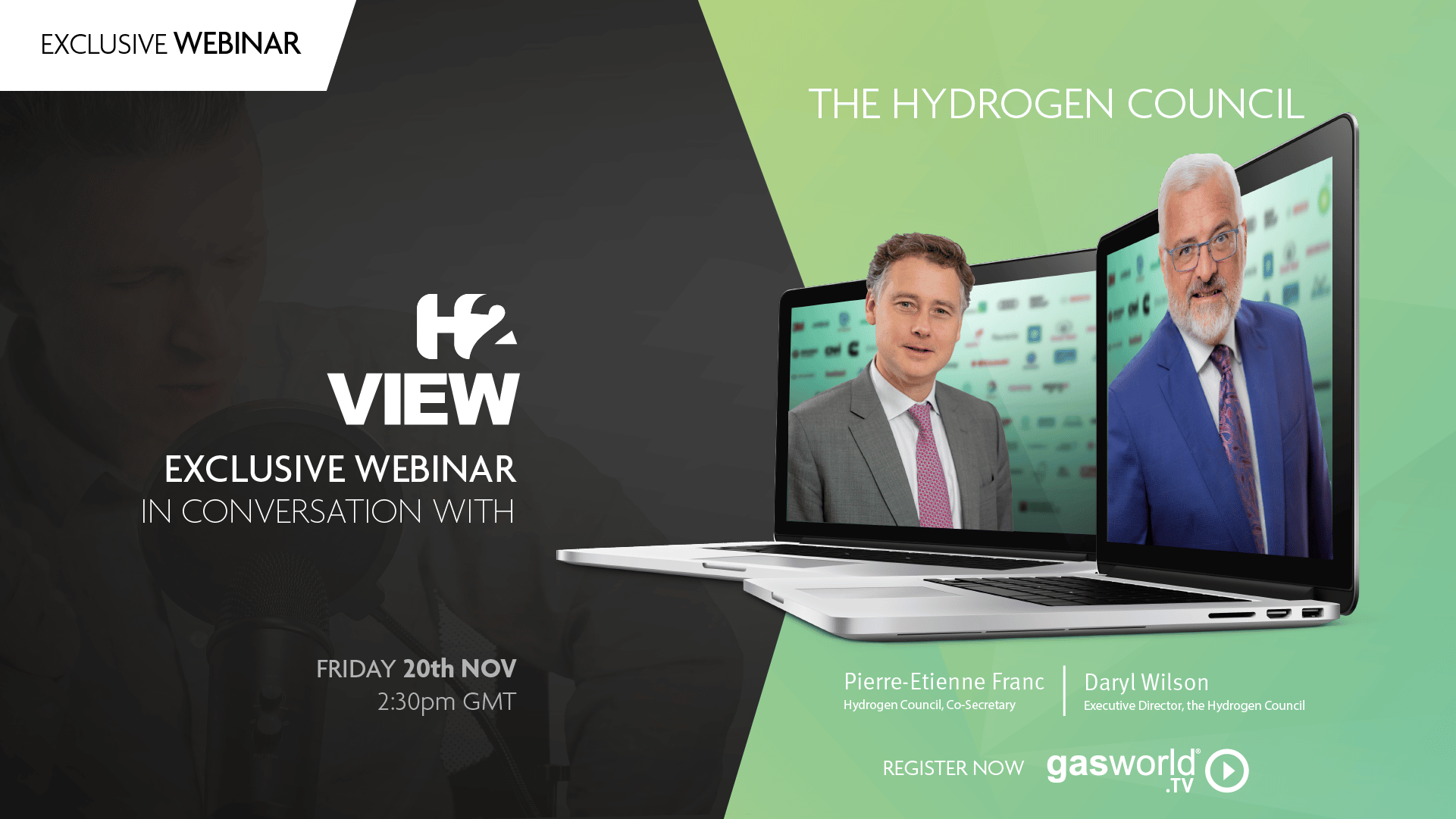

Continue readingH2 View in Conversation with… The Hydrogen Council

Amidst the global energy transition, the push for a hydrogen-driven clean recovery prompts inquiries into the market’s status, future prospects, industry actions needed, and governmental integration into COVID-19 recovery plans.

Continue readingWebinar — Hydrogen: Transatlantic opportunity for a clean energy recovery

In a July 20, 2020 webinar, Cummins’ CEO, Siemens Energy’s CEO, and experts from the US Department of Energy and the European Commission discussed cross-border hydrogen trade, infrastructure, R&D, investments, deployment incentives, and more.

Continue reading